Avanzanite Bioscience NV has raised €32m in a Series A financing round from MVM Partners, marking the company’s first institutional investment since its founding in 2022. The funding will support the expansion of Avanzanite’s operational infrastructure across 32 European countries, accelerate the commercialisation of existing and upcoming orphan drugs, and enable the company to form new alliances or acquire additional assets. MVM is investing from its €500m Fund VI and has reserved additional capital to support future growth. Dr. Jack Tanaka, Partner at MVM, will join Avanzanite’s Board.

Business model

In Q3 2025, Avanzanite reported a tripling of revenue compared with Q3 2024, along with sequential growth of over 20% compared with Q2 2025. The Series A proceeds will be used to establish new product partnerships, acquire rights to key assets, and scale regulatory and commercial operations across Europe.

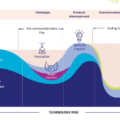

Avanzanite operates as a fully integrated commercialisation partner for biotech and pharmaceutical companies seeking to bring therapies for rare diseases to the European market. The business model addresses the continent’s fragmented healthcare landscape: Avanzanite coordinates pricing and reimbursement strategies across 32 markets, supports regulatory approvals, post-approval activities, and launch sequencing, and manages sales, medical affairs, logistics, and country-specific promotion. This integrated approach allows smaller biotech innovators to reach multiple European health systems efficiently, which is often challenging with traditional single-market launches, particularly for therapies with small patient populations.

Current portfolio

The company’s current portfolio includes three approved therapies: Sibnayal® (ADV7103), a combination of potassium citrate and potassium bicarbonate for the treatment of distal renal tubular acidosis, developed by Advicenne; AKANTIOR (Polihexanide), marketed by SIFI SpA for the treatment of Acanthamoeba keratitis; and PYRUKYND (Mitapivat), from Agios Pharmaceuticals, for patients with pyruvate kinase deficiency, a rare blood disorder. Distribution rights are held under exclusive licensing or commercial agreements across the European Economic Area, the United Kingdom, and Switzerland.

Strategic impact

MVM Partners highlights Avanzanite’s platform as a solution to the delayed patient access often seen for rare disease therapies in Europe. The Series A investment and the pan-European commercial infrastructure aim to make orphan drug launch processes more efficient while improving patient access across the continent.

No Comments

Leave a comment Cancel