Newsletter Signup – Under Article / In Page

“*” indicates required fields

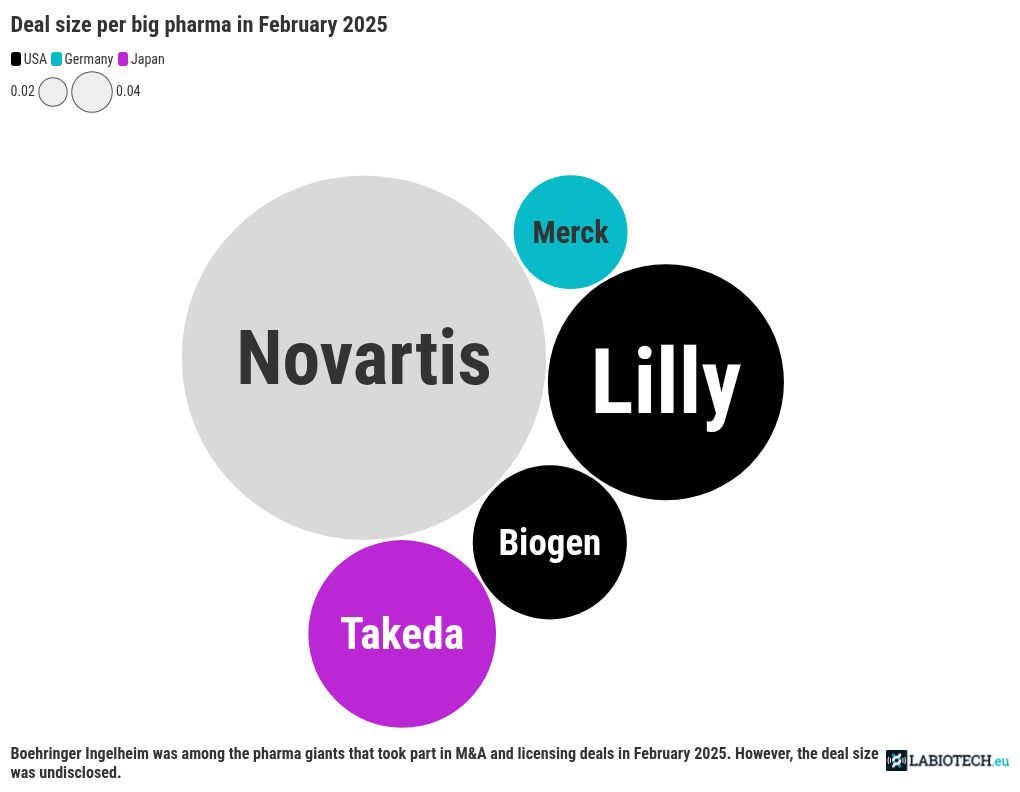

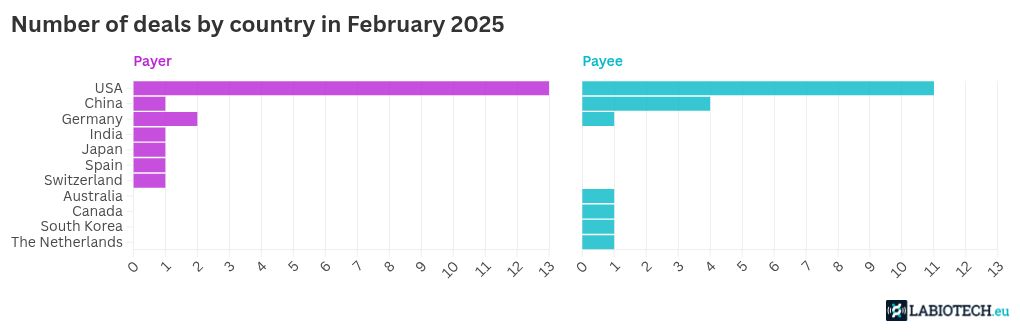

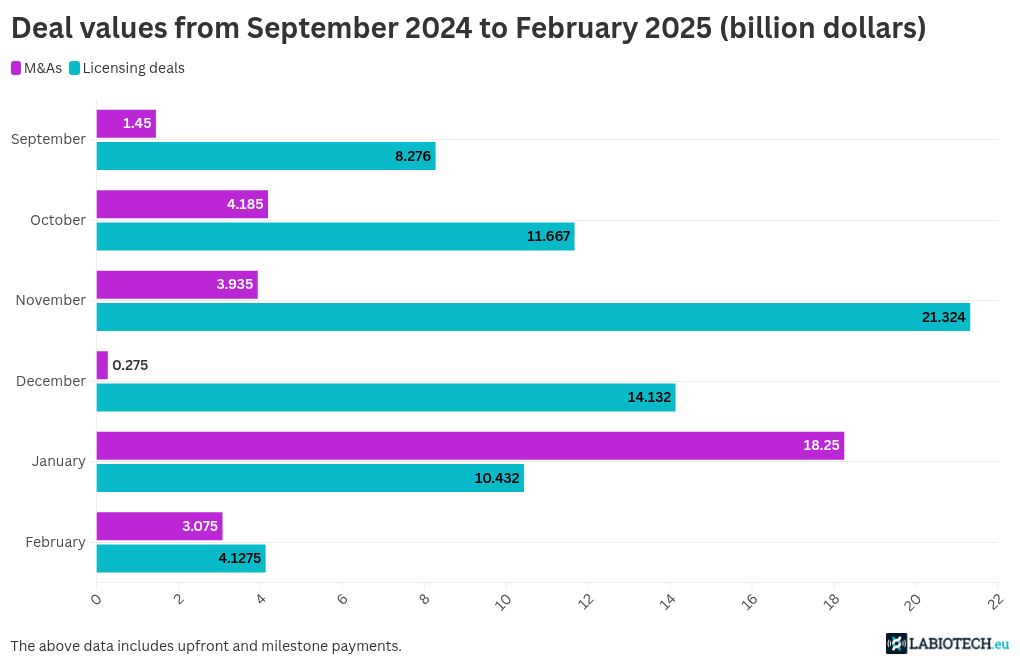

Partnerships are key to accelerating drug development in various therapeutic sectors. In February 2025, several biotech deals worth billions of dollars were inked, and once again, Eli Lilly was a top collaborator. From small molecules to T-cell engagers and RNA medicines, the major partnership trends seem to have continued last month.

Top biotech M&As of February 2025

Swiss pharma giant Novartis came out on top last month in the mergers and acquisitions (M&As) space with its buyout of Massachusetts-based Anthos Therapeutics. The deal is worth up to $2.15 billion in milestone payments, with Novartis having paid $925 million upfront. Anthos will hand over its monoclonal antibody program, which is in the clinic to prevent stroke and systemic embolism – a blockage in the blood vessels caused by an embolus particle – over to Novartis.

Lilly was another giant to nab an American biotech. It bought California-based Organovo’s FXR program. This includes the biotech’s inflammatory bowel disease drug, which Lilly will take into phase 2 trials and beyond. The financial terms of the deal were not disclosed.

Meanwhile, American biotechs Alumis and Acelyrin declared that the two would merge. They will now form a company solely focused on creating treatments for immune-mediated diseases. With a combined cash runway of $737 million, Alumis and Acelyrin stockholders will own 55% and 45% of shares in the new biotech, respectively. The two will carry on with their ongoing clinical trials – Alumis with its lead tyrosine kinase inhibitor in phase 3 studies for psoriasis and Acelyrin with its monoclonal antibody to treat thyroid eye disease. This merger comes almost a year after Alumis bagged $250 million in an initial public offering.

Biotech deals by approach in February 2025

Small molecules create a buzz in biopharma licensing

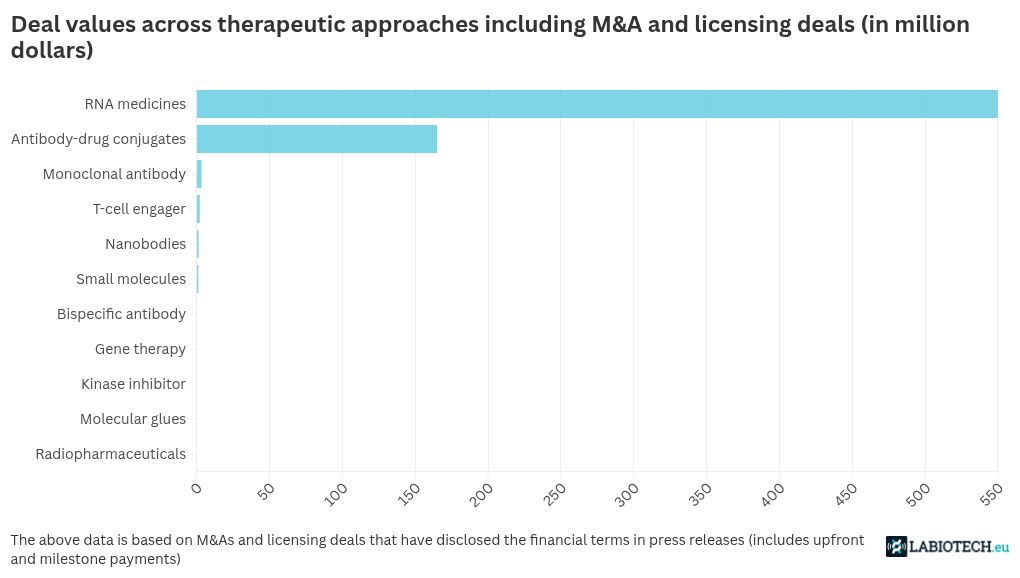

Japanese multinational biopharma Takeda has teamed up with young American biotech BridGene Biosciences to discover small molecules. The $46 million deal is focused on finding neurology and immunology drug targets. BridGene is eligible to receive $770 million in milestone payments.

And, U.S.-based Genesis Therapeutics and Incyte have signed a $30 million licensing agreement to develop small molecules. Genesis will use its artificial intelligence (AI) platform to help discover these small molecules for selected undisclosed targets. As a part of the deal, Genesis could snag up to $295 million in milestone payments.

American biotechs Immuneering and Regeneron, both focused on cancer research, have come together to develop IMM-1-104, a small molecule cyclic inhibitor, in the clinic. The drug owned by Immuneering is currently in the clinic to treat advanced non-small cell lung cancer. Immuneering has reached out to Regeneron to lend its monoclonal antibody Libtayo to use it in combination with IMM-1-104 in a phase 2 trial. The terms of the deal were not disclosed. Immuneering will continue to sponsor the planned studies.

Yet another small molecule in the mix is China-based Polymed Biopharmaceuticals’ HPB-143. The IRAK4 degrader is a phase 1-ready drug developed to address autoimmune disorders, having received Investigative New Drug (IND) clearance from the U.S. Food and Drug Administration (FDA). It will be renamed PHT-776 as American biotech Photys has now been granted global licensing rights for development, manufacture, and commercialization. The deal does not include licensing in parts of China and Southeast Asia.

Monoclonal antibodies: a licensing deal favourite in biotech in February 2025

Over in Asia, Chinese biotech Bio-Thera Solutions and Indian biotech Intas Pharmaceuticals have partnered to license BAT2506, a biosimilar of the monoclonal antibody golimumab, in the U.S. It was developed by Bio-Thera Solutions to target tumor necrosis factor alpha (TNF-a), a pro-inflammatory molecule. Intas will commercialize the drug in the U.S. through its U.S.-based cancer company Accord BioPharma and will pay $21 million upfront to Bio-Thera and up to $143.5 million in milestones.

Meanwhile, U.S.-based Vanda Pharmaceuticals and AnaptysBio are also now in cahoots with each other. They have forged a global license deal to develop and commercialize IL-36R antagonist monoclonal antibody imsidolimab, which has completed two global phase 3 trials for a rare form of the autoimmune disease psoriasis. Anaptys has secured $10 million from Vanda and $5 million for the existing drug supply. It is also eligible to receive up to $35 million for future regulatory approval and sales milestones as well as a 10% royalty on sales.

RNA medicines on licensing roll in the biotech space in February 2025

In February 2025, Pharma giant Merck inked a deal with Canadian biotech Epitopea to use its platform to identify tumor-specific antigens present in an undisclosed solid tumor. The deal, worth up to $300 million in milestones, will grant Merck the exclusive right to develop and commercialize therapeutics derived from the collaboration. Epitopea’s platform-based tumor-specific antigens are non-mutated, aberrantly expressed antigens that are derived from what were thought to be non-coding regions of the genome, which is also called junk DNA.

Another big pharma in the RNA business is Eli Lilly, which has been spending quite the penny on partnerships lately. Its collaboration with South Korean biotech OliX is to develop and commercialize the antisense oligonucleotide OLX75016 to treat metabolic dysfunction-associated steatohepatitis (MASH), a liver disease that occurs when fat builds up in the liver and causes inflammation. Currently, MASH-associated liver cancer deaths are on the rise, so treatments to curb MASH from worsening are on the radar. The financial terms of the deal were not revealed.

Moreover, global biotech Biogen has built ties with Massachusetts-based RNA therapeutics company Stoke Therapeutics. The latter’s antisense oligonucleotide zorevunersen is presently in clinical trials to treat Dravet syndrome, a rare genetic disorder and form of epilepsy that causes seizures and developmental delays in children. Zorevunersen works by targeting the SCN1A gene, which is the underlying cause of most cases of Dravet syndrome. Set to enter phase 3 trials soon, if approved, the drug candidate will be commercialized by Stoke in the U.S., Canada, and Mexico, and Biogen will take over its sales in the rest of the world. Stoke has received $165 million upfront and is expected to get up to $385 million in development and commercial milestone payments.

AI, nanobody technology, antibody-drug conjugates shake up biopharma partnerships

Meanwhile, Chinese company Harbour BioMed has tapped Massachusetts-based Insilico Medicine to boost antibody discovery and development with the help of its expertise in the artificial intelligence (AI) field. The financial terms were not disclosed.

In the nanobodies space, Spanish healthcare company Grifols and Netherlands-based FcR Therapeutics have come together to develop recombinant therapies for autoimmune diseases. The nanobodies, which are small, highly specialized antibody fragments, are designed to restrain the activity of certain Fc receptors (FcR), which are naturally occurring proteins found in immune cells that play a crucial role in immune responses, such as driving inflammation or pathogen neutralization. Grifols is helping seed the work of FcR Therapeutics and offer access to its immunoglobulin research and development (R&D) – therapies that typically help treat autoimmune diseases. The terms of the deal are yet to be revealed.

While January continued the streak for antibody-drug conjugates (ADC) in the biotech partnership space, there was only a single deal in the field in February 2025. It was between Massachusetts-based Radiance Biopharma and Chinese biotech CSPC Megalith Biopharmaceutical. The agreement was over the ADC RB-164 that targets ROR-1, which is highly expressed in solid tumors, making it an attractive target to treat several cancers. The IND-cleared drug will be licensed by Radiance in the U.S., Canada, the European Union, the U.K., Switzerland, Norway, Iceland, Liechtenstein, Albania, Montenegro, North Macedonia, Serbia, and Australia, but CSPC Megalith will retain the drug rights in the rest of the world. This comes almost two years after the Chinese biotech had inked an ADC deal with another Massachusetts-based biotech Corbus Pharmaceuticals.

The biotech has snagged $15 million upfront, and it is eligible to receive $150 million in development milestone payments and more than $1 billion in commercial milestone payments.

T-cell engagers: the much-coveted cancer therapy

Meanwhile, big pharmas are getting entangled in various other technological spaces. AbbVie has partnered with Massachusetts-based Xilio Therapeutics to develop immunotherapies, including T-cell engagers – a fast-growing therapeutic arena for cancer and autoimmune diseases. The two have penned a deal for the pharma giant to exercise the option to license certain masked T-cell engagers, which will be born out of Xilio’s technology platform. Unlike typical T-cell engagers, masked engagers are designed to activate T cells only within a tumor microenvironment by masking its T cell-binding domain that is cleaved by tumor-specific enzymes once it reaches the cancer site. This is to prevent unnecessary immune activation in healthy tissues and reduce potential side effects. As part of the deal, Xilio bagged $52 million and is eligible to receive up to $2.1 billion in milestone payments.

Moreover, in the area of T-cell engagers, Shanghai-based EpimAb Biotherapeutics seems to be picking up steam. Since forming its alliance with fellow T-cell engager biotech Candid in December, it has now signed a deal with German biotech Medigene to develop off-the-shelf T-cell engagers to treat immune-related disorders, including solid tumors. The pact calls for Medigene’s T cell receptor (TCR) generation capabilities as well as using EpimAb’s antibody and platform to develop the medicines. The financial terms were not revealed.

Big pharmas engage in gene therapies, molecular glues, and radiopharmaceuticals

German giant Boehringer Ingelheim is another major biopharma to partake in licensing deals in February. It banded together with British biotech ExpressionEdits to use its AI-powered platform Genetic Syntax Engine to develop gene therapies. The platform employs introns to enhance gene expression without altering the original genetic sequence. This is being leveraged for two gene therapy targets. The financial terms of the deal were not reported.

Finally, Lilly continued its partnership spree with Australian biotech AdvanCell and U.S.-based Magnet Biomedicine last month. The $40 million pact with American biotech Magnet Biomedicine is to get a hold of molecular glue degraders. With the help of the TrueGlue discovery platform and Lilly’s expertise in developing small molecule therapeutics, the deal aims to address difficult-to-drug targets that are linked to various diseases. Lilly is expected to pay Magnet up to $1.25 billion in milestone payments.

Its contract with AdvanCell is in the realm of radiopharmaceuticals. Targeted alpha therapies, which are a kind of radiopharmaceutical, work by delivering highly energetic alpha particles specifically to cancer cells in order to damage them through carrier molecules like monoclonal antibodies. While much is not known of the financial terms of the agreement, they announced that the drugs will be lead-based and the two companies will work together to accelerate clinical trials.

Partnering 2030: Biopharma Report

Download Inpart’s latest report revealing the priorities of out-licensers worldwide.

No Comments

Leave a comment Cancel